Tampa, FL, is a vibrant city with a unique blend of urban excitement and suburban comfort. Whether you’re navigating busy highways like I-4, I-275, or Dale Mabry Highway, or commuting through neighborhoods like South Tampa, Hyde Park, or New Tampa, having the right auto insurance in Tampa FL is essential to protect yourself from the unexpected. In fact, finding the best auto insurance in Tampa FL can help you stay protected against the unique challenges Tampa drivers face daily. With Tampa’s rapid growth, it’s more important than ever to make sure you’re properly covered.

In this article, we’ll explore the key factors that affect your car insurance in Tampa FL, coverage options you should consider, and how local factors like traffic, weather, and road conditions can impact your rates.

Unique Driving Challenges in Tampa, FL

Tampa’s diverse roads and busy streets present several challenges for drivers, making the right auto insurance in Tampa FL crucial. Here are a few things you should keep in mind:

1. Heavy Traffic and Congestion

Tampa is a major metropolitan area with significant traffic, especially during rush hours. Major roads like I-275, I-4, Dale Mabry Highway, and Bruce B. Downs Boulevard are notorious for congestion. Events at Raymond James Stadium, downtown concerts, and even beach traffic along Gandy Boulevard can lead to unexpected delays and accidents. More traffic means a higher likelihood of fender-benders, making the right auto insurance in Tampa FL crucial to staying protected.

We believe your time on Tampa’s roads should be as stress-free as possible. Because your protection matters, we work hard to find the best auto insurance in Tampa FL to suit your driving habits and the local traffic conditions.

2. Weather Hazards

Living in Tampa means frequent exposure to severe weather, from sudden downpours to hurricane threats. The summer months bring frequent rainstorms, leading to slippery roads and dangerous driving conditions. Tampa’s coastal location also means that hurricanes can pose a serious risk, causing flooding and damage to vehicles.

Because your vehicle’s safety matters, we ensure you have comprehensive coverage to protect against weather-related damages. From debris during storms to flood risks, your auto insurance in Tampa FL should give you peace of mind.

3. Road Construction and Development

Tampa is a city constantly evolving, with ongoing construction and infrastructure improvements throughout the area. Major roads like Bruce B. Downs Boulevard in New Tampa, Dale Mabry Highway, and Westshore Boulevard frequently experience roadwork. Construction zones can increase the risk of accidents, so having the proper auto insurance in Tampa FL with collision coverage is vital to protecting your vehicle.

We believe in keeping you protected no matter the situation. With Tampa’s expanding development, your car insurance in Tampa FL should cover you from all potential risks, including roadwork-related incidents.

Key Auto Insurance Coverage Options for Tampa Drivers

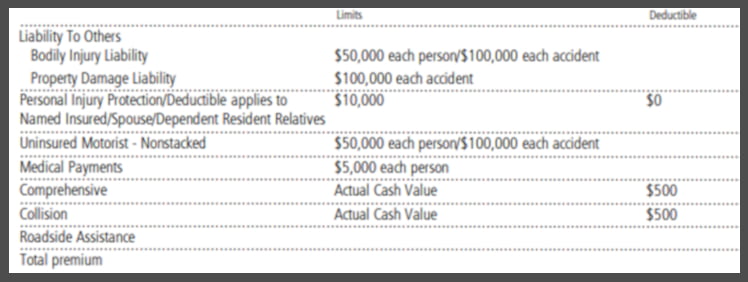

It’s not just about having auto insurance in Tampa FL—it’s about making sure you have the right coverage to meet your needs. Florida law requires drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL), but these minimums may not fully protect you. Here are a few coverage options Tampa drivers should consider:

1. Liability Insurance with Higher Limits

Liability insurance covers the costs if you’re responsible for an accident that causes injury or property damage. With Tampa’s traffic congestion, the risk of accidents is higher. Having higher liability limits can provide greater financial protection, ensuring you don’t end up paying out-of-pocket if damages exceed your policy limits.

We believe your financial security matters. You deserve liability limits that protect you in case of a major accident, especially in a busy city like Tampa.

2. Collision and Comprehensive Coverage

Collision coverage helps pay for repairs to your vehicle if you’re in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-accident-related damages such as theft, vandalism, or storm damage—especially important with Tampa’s weather hazards.

Because safeguarding your vehicle matters, we’ll help you choose collision and comprehensive coverage that suits Tampa’s unique risks, including weather and heavy traffic.

3. Uninsured Motorist Coverage

Florida has a high percentage of drivers without insurance, making uninsured motorist coverage crucial for protecting yourself in case of an accident caused by an uninsured driver. This coverage helps pay for medical expenses if you’re injured by a driver who doesn’t have sufficient insurance.

You deserve to feel safe on the road, knowing you’re protected from the unexpected, even when the other driver doesn’t have insurance.

Driving in New Tampa: What You Need to Know

New Tampa is one of Tampa’s fastest-growing suburban areas, offering a quieter lifestyle while still being connected to the city. But with that growth comes new challenges for drivers. Major roads like Bruce B. Downs Boulevard are frequently congested, especially during rush hour, as residents commute to and from the city.

Auto insurance in New Tampa should account for the area’s rapid growth and traffic conditions. Whether you’re driving through neighborhoods like Hunter’s Green or Tampa Palms, it’s important to have sufficient liability and collision coverage to protect against accidents. The area’s continued development also means road construction is a frequent occurrence, increasing the risk of fender-benders.

Because your peace of mind matters, we help you find the best car insurance in Tampa FL that includes the right protection for New Tampa’s unique driving conditions.

How to Get the Best Auto Insurance Rates in Tampa, FL

With so many factors influencing auto insurance in Tampa FL rates, here are a few ways you can lower your premiums:

1. Maintain a Clean Driving Record

Insurance companies reward safe drivers. Avoiding accidents and traffic violations can help you secure lower rates. In Tampa’s busy environment, practicing defensive driving on major roads like I-275 and Dale Mabry Highway can help you maintain a clean record.

2. Bundle Your Policies

If you own a home in Tampa or have other insurance needs, bundling your auto insurance in Tampa FL with homeowners insurance in Tampa FL or renters insurance can save you money. Although not all companies offer Florida homeowners insurance, for those that do, like AAA insurance, bundling policies often results in discounts that lower your overall premiums.

3. Take Advantage of Discounts

At Think Safe Insurance, we work with multiple carriers to find discounts that fit your profile, including multi-car discounts, good student discounts, claims-free discounts, and telematics-based programs that reward safe driving.

4. Improve Your Insurance Score

Your insurance score, which includes factors like your credit history, can impact your auto insurance in Tampa FL rates. Improving your credit score may help lower your premiums.

To get a personalized quote, call us at 813-425-1626 or visit our Request a Quote page.

5. Stay Current on Insurance and Registration

In Tampa, maintaining both valid auto insurance and vehicle registration is essential. To legally drive in Hillsborough County, your vehicle must be registered, and you’ll need up-to-date insurance coverage to complete the process. Keeping your insurance active ensures you’re ready when it’s time to renew your registration.

For more information on vehicle registration and renewal requirements, visit the Hillsborough County Tax Collector’s website.

Why Work with Think Safe Insurance in Tampa, FL?

At Think Safe Insurance, we understand the unique challenges of driving in Tampa and the importance of having the right auto insurance in Tampa FL. Here’s how we help you:

- We focus on solutions that fit you: Whether you’re looking for higher liability limits, comprehensive coverage, or ways to lower your premium, we’ll tailor your coverage to your needs.

- Access to multiple carriers: As an independent agency, we work with a variety of insurance providers to ensure you get the best rates on your car insurance in Tampa FL without compromising on protection.

- Ongoing support: We’re here to help not just when you purchase a policy but throughout the entire duration. If you need adjustments, have questions, or need to file a claim, we’ll be there to guide you.

- Convenient 24/7 access: With our agency’s app, you can manage your auto insurance in Tampa FL anytime, anywhere—even if you have policies with different carriers.

Because your convenience matters, we make it easy to manage your policies and ensure your protection at all times.

FAQs about Auto Insurance in Tampa, FL

- What does liability coverage include?

- Do I need uninsured motorist coverage in Tampa?

- What’s the difference between comprehensive and collision coverage?

- When should I remove full coverage from my car?

- Who should be listed as a driver on my policy?

- What discounts can I qualify for in Tampa?

Conclusion

Tampa’s roads present unique challenges for drivers, from heavy traffic to weather hazards. Having the right auto insurance in Tampa FL is critical to protect yourself and your vehicle. At Think Safe Insurance, we believe you deserve coverage that gives you peace of mind, no matter where you’re driving in the city.

Get a quote today by calling 813-425-1626 or visiting our Request a Quote page to explore your options for car insurance in Tampa FL.

Think Safe Insurance, LLC

116 E Bloomingdale Ave Ste B

Brandon, FL 33511

813-425-1626

https://maps.app.goo.gl/W79FJeX1CnXW7qMz6