Table of Contents[Hide][Show]

- Why Auto Insurance Is Important in Florida

- Why You Should Consider Higher Liability Limits

- Personalized Coverage Tailored to You

- Independent Coverage That Works for You

- How to Get Started with Your Florida Auto Insurance

- Convenience and Savings with Think Safe Insurance

- Why Regular Policy Reviews Matter

- Auto Insurance – Frequently Asked Questions (FAQs)

- Access Your Policy Anytime with Our Agency App

- Get Your Free Florida Auto Insurance Quote Today

Finding the best auto insurance in Florida doesn’t have to be complicated. At Think Safe Insurance, we make protecting your car and finances simple and stress-free. With coverage that suits your needs, you can hit the road knowing you’re protected from the unexpected.

Learn how Think Safe Insurance helps drivers across Florida find affordable auto insurance without the hassle. Watch this short video to discover how you can save money and drive with peace of mind.

Why Auto Insurance Is Important in Florida

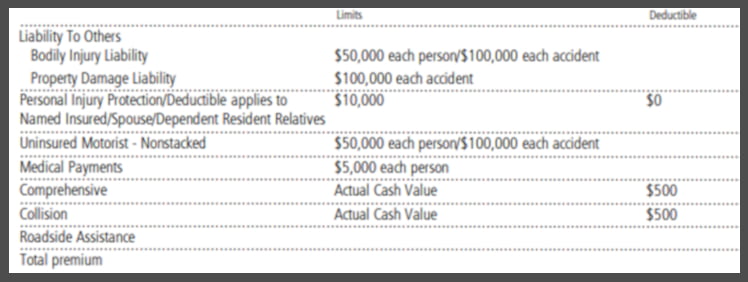

Florida law requires Personal Injury Protection (PIP) and Property Damage Liability (PD) (Learn more: minimum requirements & accident requirements), but these minimums often leave you facing unexpected expenses, from costly medical bills to extensive car repairs.

At Think Safe Insurance, we help protect you from these unexpected expenses by recommending higher limits, like $100,000 per person / $300,000 per accident / $100,000 in property damage liability. With the right coverage, you can feel confident no matter what the road brings.

Because your financial protection matters, we’ll help you find coverage that shields you from the unexpected, whether it’s a fender bender or a serious accident.

Why You Should Consider Higher Liability Limits

Meeting Florida’s minimum coverage requirements is just the start. Without higher liability limits—like $100,000 per person / $300,000 per accident—you could face significant financial losses after an accident, from medical bills to legal fees.

At Think Safe Insurance, we make it easy to get affordable, enhanced coverage so you’re always ready for what’s ahead.

Because your security on the road matters, we’ll take the time to walk you through all your options, so you can make an informed choice that suits your budget and lifestyle.

Related: Auto Resources

Personalized Coverage Tailored to You

At Think Safe Insurance, we work with a range of trusted companies like:

At Think Safe Insurance, we work with top insurers like AAA, Allstate, and Progressive to bring you competitive rates and reliable coverage. As an independent agency, we compare options from multiple carriers, saving you time and effort while finding the best policy for your needs.

Let us handle the hard work so you can focus on what matters most—driving with confidence.

Because your convenience matters, our goal is to find you the best coverage at a competitive price, without compromising on quality. Don’t forget to get your homeowners insurance quote, too!

Independent Coverage That Works for You

At Think Safe Insurance, we’re committed to finding the best auto insurance for your unique situation. We’ll review your current policy, identify gaps, and recommend only what you truly need—so you’re protected without paying for unnecessary extras.

Our independent agency status allows us to compare Florida auto insurance coverage and rates from multiple carriers to ensure you get the best deal possible. We’re not tied to any one company, so we can focus on what matters most — finding the right policy for you.

How to Get Started with Your Florida Auto Insurance

Getting the right auto insurance in Florida has never been easier. All you need is:

- Copy of your current policy if available

- Driver info

- Your coverage preferences

Not sure what coverage limits you need? Don’t worry—our friendly experts are here to guide you every step of the way. Start today and enjoy peace of mind knowing your protection is in good hands.

Convenience and Savings with Think Safe Insurance

At Think Safe Insurance, we make finding the right coverage simple and affordable. Whether you’re a new driver, managing multiple vehicles, or looking for insurance for an older car, we’ll help you find the best policy. Let us save you time, money, and hassle with our expert guidance.

Because your time is valuable, we handle the heavy lifting. As an independent agency, we shop multiple carriers on your behalf, finding you the best rates without the hassle. Plus, while you’re here, why not get a quote for your homeowners insurance as well? Protecting all your assets, not just your vehicle, is key to long-term peace of mind.

Why Regular Policy Reviews Matter

Your life changes—and so should your insurance. Regular policy reviews ensure you’re always adequately covered and never overpaying. Whether you’ve paid off a car, added a driver, or upgraded your vehicle, we’ll help you adjust your coverage for the best value. Contact us anytime for a free, personalized review.

Auto Insurance – Frequently Asked Questions (FAQs)

Navigating auto insurance can raise a lot of questions. From understanding coverages to rental specifics, we’ve got answers to your most pressing questions:

- Liability Coverage – What Does Each Number Mean?

- Do I Need Uninsured Motorist Coverage?

- What is the Difference Between Comprehensive and Collision Coverage? Do I Need Both?

- Do I Need Full Coverage? When Should I Remove Comprehensive and Collision Coverage?

- I Paid Off my Vehicle. What Does That Mean for my Insurance?

- Am I Covered to Rent a Car?

- Am I Covered to Rent a U-Haul / Moving Truck?

- Am I Covered to Rent a Motorhome / RV?

- Moving to Florida

Access Your Policy Anytime with Our Agency App

At Think Safe Insurance, we believe convenience matters. That’s why we offer a free, easy-to-use insurance mobile app, giving you 24/7 access to your insurance policy, ID cards, and documents. Whether you need to check your coverage, download your auto insurance card, or make a payment, you can do it all from your phone, anytime, anywhere.

- Manage your policy on the go

- View and download ID cards

- File claims quickly and easily

Because your time and convenience matter, we’ve made managing your auto insurance simpler than ever.

Get Your Free Florida Auto Insurance Quote Today

Don’t wait to secure affordable, reliable auto insurance in Florida. At Think Safe Insurance, our expert agents are ready to help you find the protection you need at a price you’ll love. Contact us today for your free, no-obligation quote.

Contact us today for a free, no-obligation quote. Call us at 813-425-1626 or fill out our online form to start the process.