Table of Contents[Hide][Show]

Brandon, FL, is a growing hub with welcoming neighborhoods, thriving businesses, and excellent highway connectivity. As the region grows, having dependable auto insurance in Brandon FL is crucial to safeguard your vehicle and stay worry-free.

As Brandon and nearby suburbs grow, having auto insurance in Brandon FL that provides comprehensive protection is more important than ever. Whether commuting on State Road 60, visiting neighborhoods like Providence Lakes or Sterling Ranch, or navigating ongoing construction, the right coverage keeps you prepared for the unexpected.

This guide explores the key factors affecting auto insurance in Brandon FL, highlights essential coverage options, and explains how local driving conditions may influence your car insurance rates.

Unique Challenges of Driving in Brandon, FL

Brandon drivers face unique challenges, from increasing traffic to constant road construction. Having reliable auto insurance in Brandon FL ensures you’re covered for whatever the road brings.

Heavy traffic on roads like Bloomingdale Avenue and Kings Avenue increases the likelihood of accidents. Brandon drivers face significant congestion at the SR 60 and Kings Avenue intersection, where the reduction in lanes between Kings and Kingsway creates constant merge hazards. High-volume traffic around the Brandon Exchange also adds to the daily risk of fender-benders.

Here are some key factors to keep in mind:

1. Navigating Traffic and Congestion

As a central hub for commuters from nearby suburbs like Riverview and FishHawk Ranch, Brandon experiences increasing traffic on major roads such as Lumsden Road and Bloomingdale Avenue. With congestion rising near landmarks like Kings Avenue and Westfield Brandon Mall, having reliable auto insurance in Brandon FL is more essential than ever.

We believe in helping you stay protected from life’s unexpected events. Your safety on Brandon’s roads matters, and our agency works hard to find the right car insurance in Brandon FL—one that keeps you confident, no matter the traffic ahead

2. Handling Road Construction Challenges

With constant construction on State Road 60 and Lithia Pinecrest Road, detours and debris-related hazards are frequent. Ensure your policy includes collision and comprehensive coverage to safeguard against accidents and weather-related damage.

Because protecting your vehicle from the unpredictable matters, we make sure that your auto insurance in Brandon FL is designed to handle the specific risks you face on Brandon’s roads, providing tailored protection that suits your needs..

3. Claims Frequency and Severity

Auto insurance rates in Brandon are shaped by both the frequency and severity of claims. High traffic and ongoing construction contribute to a greater risk of accidents, while rising repair costs and advanced vehicle technology increase claim expenses. These factors influence your auto insurance in Brandon FL, making it crucial to choose the right coverage for your needs.

Key Auto Insurance Coverage Options for Brandon Drivers

Auto insurance in Brandon FL is more than a legal obligation; it’s a safeguard for you and your family, offering tailored, affordable coverage that meets your unique needs.

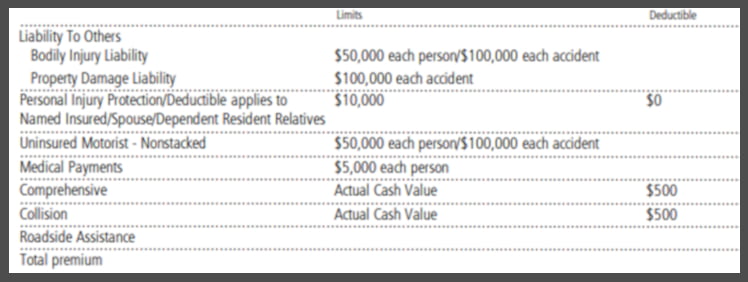

While Florida law requires drivers to carry Personal Injury Protection (PIP) and Property Damage Liability (PDL), these minimums may not be enough to protect you fully (FLHSMV). Here are a few important coverage options to consider:

1. Liability Insurance with Higher Limits

Liability coverage is essential for covering costs if you’re responsible for an accident that causes injury or property damage. But in today’s world, the state minimums are often insufficient. Higher limits of bodily injury liability are important for Brandon drivers, especially those using the Selmon Expressway or I-75 for their daily commute. At highway speeds, the financial fallout of an accident can easily exceed Florida’s state minimums, leaving your personal assets at risk. Learn more about Auto Liability Coverage

We believe that your financial security should never be compromised by insufficient coverage. You deserve liability limits that truly protect you from unexpected costs, ensuring your future remains secure, even after an accident.

2. Collision and Comprehensive Coverage

While liability coverage protects others, collision and comprehensive coverage protect your own vehicle.

- Collision coverage will help pay for repairs or replacement if your car is damaged in an accident, regardless of fault.

- Comprehensive coverage protects against non-accident incidents. In Brandon, this is essential for protection against rising water during heavy storms and damage from falling limbs—a major factor in our more established, tree-lined neighborhoods.

Learn more about the difference between comprehensive and collision coverage.

Accidents and weather-related damage are unpredictable—collision and comprehensive coverage in your auto insurance in Brandon FL policy keep your vehicle protected at all times.

For more information about these coverage types, visit our auto insurance coverage pages.

3. Uninsured Motorist Coverage

Florida has a high percentage of drivers without insurance. Uninsured motorist coverage helps cover medical expenses if you’re injured in an accident caused by a driver who doesn’t have insurance. However, in Florida, this coverage does not apply to property damage—so you’ll still need collision coverage to protect your vehicle in such cases. Learn more about Uninsured Motorist coverage.

In a state with a high percentage of uninsured drivers, having uninsured motorist coverage ensures you won’t bear the financial burden of medical expenses after an accident caused by an uninsured driver.

Because your health and well-being matter, we’ll help you ensure you’re covered from the unexpected.

How to Find the Best and Most Affordable Auto Insurance in Brandon FL

Finding affordable auto insurance in Brandon FL doesn’t have to be difficult. By following these strategies, you can secure the best rates and coverage to fit your needs.

1. Maintain a Clean Driving Record

Insurance companies reward safe drivers. By avoiding accidents and traffic violations, you can keep your rates low. In a high-traffic area like Brandon, practicing defensive driving on roads like Kings Avenue and Lumsden Road can help you avoid accidents and maintain a clean record.

Your safety matters—not just for avoiding accidents but for keeping your premiums low. A clean record is one of the simplest ways to secure affordable auto insurance in Brandon FL.

2. Don’t Switch Carriers Too Often

Switching insurance carriers every six months may seem like a way to find lower premiums, but insurers look at how long you’ve been with your previous provider as a rating factor. Staying with a carrier for an extended period can help you secure better rates and avoid penalties related to frequent switching when the time comes to shop your policy again.

3. Bundle Your Policies

If you own a home in Brandon or have other insurance needs, bundling your auto insurance in Brandon FL policy with your homeowners or renters insurance can help you save on both policies. Although many carriers in Florida don’t offer Brandon homeowners insurance and auto, there are some like AAA insurance in Florida that do.

4. Take Advantage of Discounts

At Think Safe Insurance, we work with multiple carriers to find discounts that you may qualify for, such as multi-car discounts, good student discounts, claims-free discounts, and telematics-based programs that reward safe driving habits.

5. Improve Your Insurance Score

Another factor that influences your auto insurance in Brandon FL rates is your insurance score, which incorporates elements of your credit history. The insurance industry has found correlations between credit information and the likelihood of filing a claim. Improving your credit score can, in turn, help lower your insurance premiums.

For a personalized quote, call us at 813-425-1626 or visit our Request a Quote page.

Why Work with Think Safe Insurance?

At Think Safe Insurance, we put your needs first, ensuring that you have access to the best coverage options without any added stress. Here’s how we help you, the client, beyond simply providing insurance:

- We focus on solutions that fit you: Our approach is tailored to your specific situation, whether you’re looking for higher liability limits, comprehensive coverage, or ways to reduce your premium. We believe in taking the time to understand your needs before offering recommendations.

- Access to multiple carriers: As an independent agency, we have access to a wide range of insurance providers. This allows us to compare rates and coverage options across the market, ensuring you get the best deal available—without compromising on protection.

- Ongoing support: We’re here for you, not just when you purchase a policy, but throughout your coverage period. Whether you need to make adjustments, have questions, or file a claim, we’ll be there to guide you.

- Convenient 24/7 Access to Your Policies: With our agency app, you can access your auto insurance in Brandon FL or other areas we serve and other policies anytime, anywhere—even if they’re with different carriers. Whether you have auto insurance with Progressive Insurance and homeowners insurance with Southern Oak Insurance, our app makes it easy to manage everything in one place. You deserve the convenience of having all your insurance information at your fingertips.

- We believe in transparency: Because your trust matters, we prioritize clear, upfront communication. You’ll know exactly what you’re getting and why it matters for your financial security.

At Think Safe Insurance, we’re more than an insurance agency—we’re your trusted partner. From comparing rates for affordable auto insurance in Brandon FL to ensuring you understand your coverage, our mission is to provide peace of mind to every Brandon driver.

Contact us today at 813-425-1626 or visit our Request a Quote page to explore your options.

FAQ: Auto Insurance in Brandon FL

Have questions about your auto insurance in Brandon FL? These FAQs cover everything from coverage options to saving tips, ensuring you stay informed and protected.

- Liability Coverage – What Does Each Number Mean?

- Do I Need Uninsured Motorist Coverage?

- What is the Difference Between Comprehensive and Collision Coverage? Do I Need Both?

- Do I Need Full Coverage? When Should I Remove Comprehensive and Collision Coverage?

- I Paid Off my Vehicle. What Does That Mean for my Insurance?

- Am I Covered to Rent a Car?

- Am I Covered to Rent a U-Haul / Moving Truck?

- Am I Covered to Rent a Motorhome / RV?

- Moving to Florida

Conclusion

As Brandon’s population grows and road conditions evolve, ensuring you have the best and most affordable auto insurance in Brandon FL is essential.

At Think Safe Insurance, we help you find coverage that provides peace of mind, protection, and value—all at a price you can afford. Let us help you find the coverage that fits your needs and budget.

To get a quote, visit our Request a Quote page or call us at 813-425-1626. Drive with confidence, knowing you’re fully protected.